Are you stumped by your pay stub and want to learn how to read it? You surely know when you get paid, but knowing how to read your pay stub can be tricky. You work hard for what you earn, so you should understand where your money goes. Pay stubs, apart from the section showing take-home-pay, are complex. So, it’s time you really understand how to read your pay stub, and we’re here to help. We asked our very own Director of Payroll and Accounting to help us make sense of it all.

Below is a breakdown of your pay stub section by section, so you can familiarize yourself with the true value of your paycheck.

Your Pay Stub: The Basics

As you are getting to know your paycheck, these are the basics that you should review:

1. Your name

2. Check date

3. Pay rate (it’s calculated in hours regardless of whether you’re a salaried employee or paid by the hour)

4. Your wages

5. Tax withholding

6. Deductions

7. Net pay (take-home amount)

Still stumped? After the basics, the calculation toward your net pay begins.

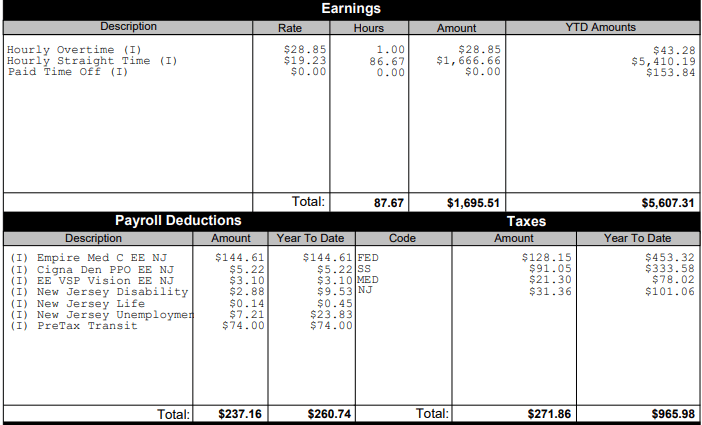

Employee Earnings/Gross Pay

Details of your total earnings for the current pay period before taxes, withholding and contributions are factored are shown here.

Your gross pay is your total amount of wages earned, plus any additional amounts such as:

1. Overtime pay

2. Bonuses

But what exactly are they withholding?

Employee Taxes Withheld

Your net pay (take-home pay) is your gross pay minus your deductions, tax withholding and contributions. As for taxes that are mandated by the government such as Social Security and Medicare withholding (commonly known as FICA), we cannot select status or exemption. Both are deducted from every employee’s pay. Social Security is calculated at a rate of 6.2% of your pay while Medicare is calculated in relation to your income level.

The Federal government, states and local authorities use 4 items to calculate withholding from your paycheck:

1. Marital status

2. Exemptions or allowances you claimed on your W-4 form

3. Additional withholding you elected (such as an extra $5.00 per paycheck for federal tax)

If you earn under $200,000 you pay 1.45% of your taxable earnings, and if you earn more than $200,000, your taxable pay is taxed at a rate of 2.35%. Is it adding up, yet? After withholding, there is even more to deduct. The IRS has a nifty calculator available to estimate your tax withholding based on your individual situation.

Employee Deductions

Pre-tax deductions are key when it comes to reading your pay stub.

Some of these deductions may include:

1. 401k

2. Insurance coverage for medical, dental, and/or vision

3. Parking and transit benefits

4. Dependent health care

5. FSA and HSA plans

There are also deductions which are mandated by the state such as:

1. NY Paid Family Leave

2. New Jersey Disability

3. PA Unemployment

Yes, our gross income continues to be reduced to reach that net pay in your paycheck, but the burden is not on you alone. Your employer has deductions when it comes to you, too!

Employer Taxes and Contributions

Now that you’ve learned about your deductions, here are a few ways your employer pays on behalf of you:

1. Federal Unemployment Taxes (FUTA)

2. State Unemployment Taxes (SUTA)

3. Social Security on behalf of employees

4. Medicare on behalf of employees

You may also see employer costs for health and benefits offerings such as medical insurance or a company 401k match. The most important thing to note is that nothing in this section impacts your net pay!

Net Pay

The total amount of your paycheck is what’s considered your net pay or “take-home pay, so it’s important when reviewing your pay statement to verify the following:

1. Your pay rate- is it correct based upon your pay period schedule?

2. Your taxes- are they accurate according to the state in which you reside?

3. Your benefits- are they being deducted as expected?

4. Your 401k- is the percentage you’re contributing to your 401k being deducted correctly?

5. Your address- is it correct (if your paychecks are being mailed, this is especially important)!

For a better understanding of how to read your paycheck, employees should not only familiarize themselves with their pay stubs, but also contact their payroll department. They are experts, so ask someone to walk you through your pay stub information and other relevant compensation details. The more you know about how to read your pay stub, the more informed you can be regarding your deductions and contributions in the future. Don’t be pay stub stumped, learn how to read your pay stub and know the value of your paycheck. You’re worth it!